CEOs currently need to lead through a lot of chaos and confusion. Rising costs, slower customer decisions, and geopolitical uncertainty are creating real challenges. At the same time, rapid AI adoption is opening both new opportunities and fast growing competitive threats across market and fundraising landscapes.

To better understand how companies are experiencing and navigating these conditions, we asked CEOs in our High-Growth CEO Forums (HGCFs) to share their recent reflections. Their perspectives, drawn from candid peer discussions, reveal a mix of resilience, cautious optimism, and sharpened focus on strategic priorities.

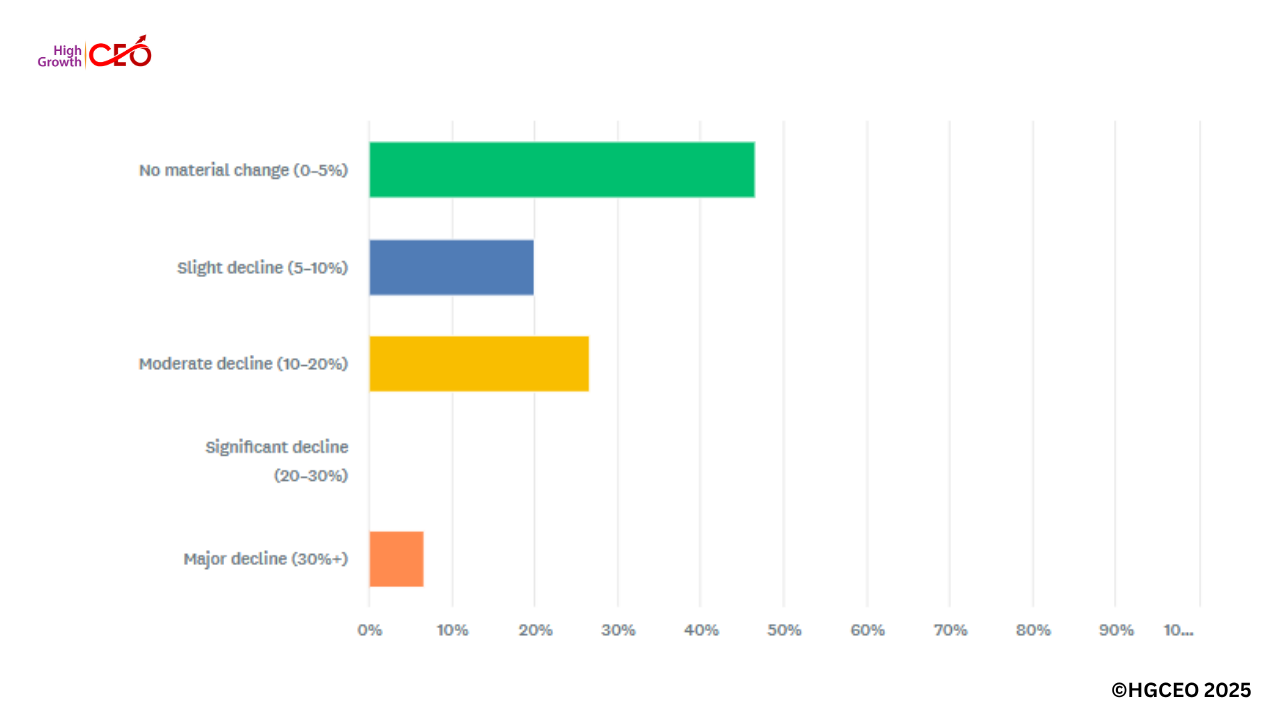

“Nearly half of CEOs reported no material change in recent revenue performance, while a quarter saw moderate declines.”

CEO Perspectives on Recent Performance

When asked how revenue and closed-won performance compared to forecast, CEOs reported a wide range of outcomes. Nearly half said they experienced little or no material change, a signal that steady demand and strong pipeline conversion remain possible in today’s market. At the same time, one in four experienced moderate declines, citing rising costs, delayed customer approvals, and shifting internal priorities as key reasons. A smaller, but significant, group reported major declines of 30 percent or more. For these CEOs, volatility is very real and often outside their direct control.

The qualitative reflections behind the numbers add important context. As one CEO put it, “The appetite is there, the approvals are just slower.” Another explained, “Internal bandwidth is now one of our biggest bottlenecks.” These perspectives underscore that while many CEOs are holding ground, others are fighting uphill battles against forces that include both market dynamics and internal constraints.

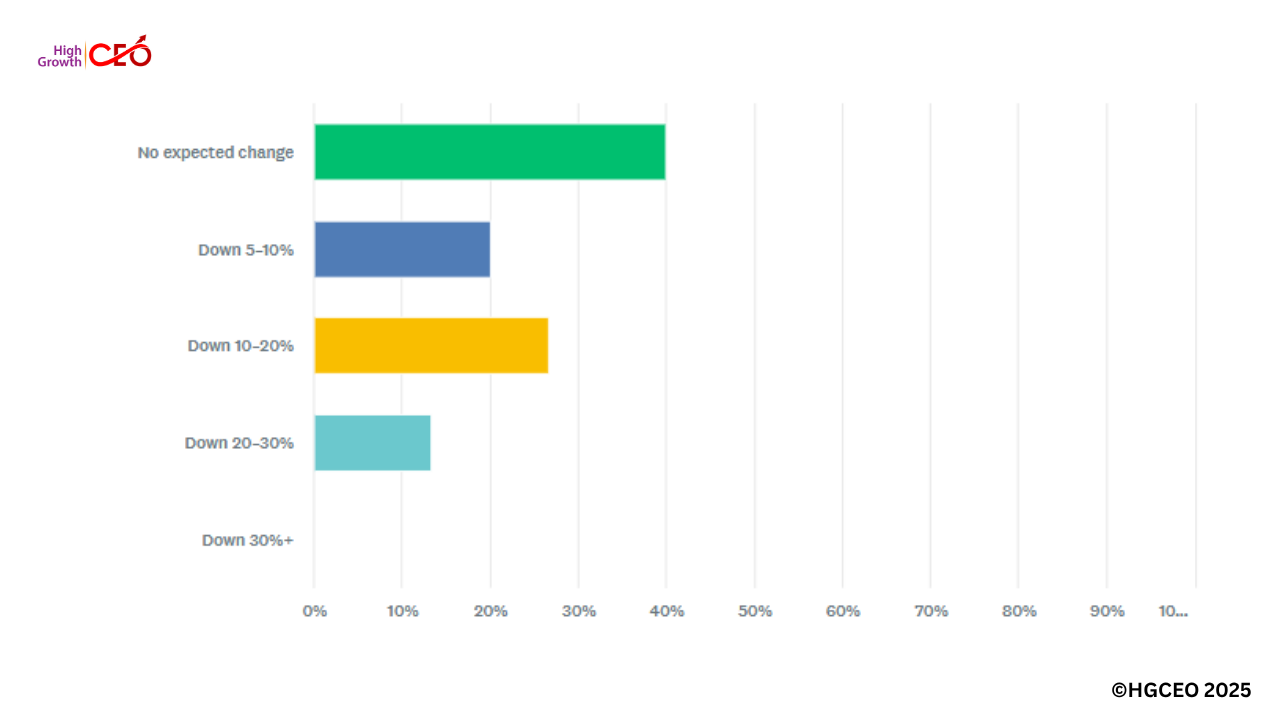

CEO Outlook for the Months Ahead

Looking forward, CEOs are preparing for the remainder of 2025 with a pragmatic lens. Roughly 40 percent expect no material change from their original forecasts, which suggests confidence in their positioning and resilience in their industries. Another 40 percent expect performance to be down between 5 and 20 percent, reflecting continued caution and a recognition that external conditions may weaken pipelines even if demand holds. A smaller group anticipates sharper declines of more than 20 percent and are bracing their companies for more aggressive cost discipline.

To illustrate this, the survey data shows a nearly even split: 40 percent holding steady, 40 percent expecting modest declines, and 20 percent bracing for significant headwinds.

“CEO outlook for the remainder of 2025 reflects pragmatism: 40% expect steady performance, while another 40% anticipate modest declines.”

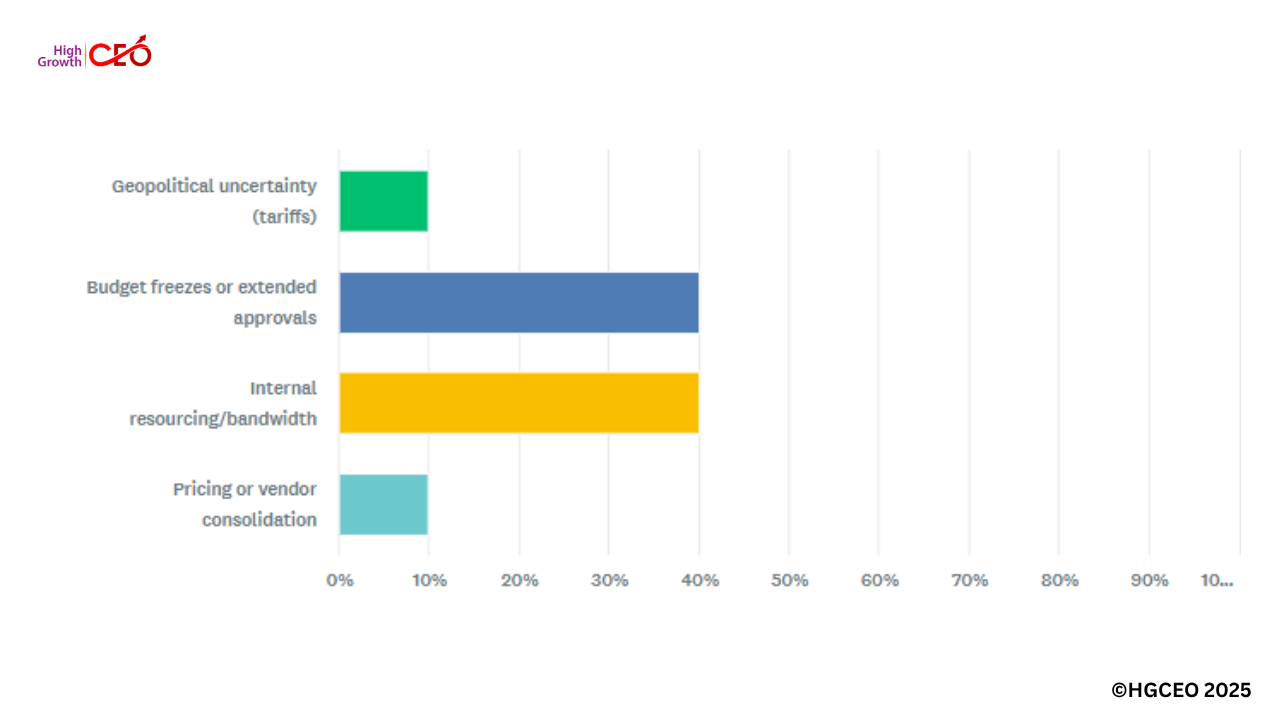

The underlying rationale for these expectations offers deeper insight. When asked what is driving this outlook, two factors stood out:

- Internal resourcing and bandwidth – CEOs are prioritizing where to place limited time and capital, often delaying lower-priority initiatives.

- Budget freezes and extended approvals – Even when appetite exists, approvals are slower, requiring CEOs to manage pipeline health more closely.

Together, these accounted for the majority of slowdown reasons cited.

“Budget freezes and internal bandwidth constraints were cited most often as reasons for slower cycles.”

Not every outlook was defensive. Several CEOs emphasized that technology, particularly AI, is creating measurable offsets. One remarked, “AI-driven efficiencies allowed our teams to close deals faster than expected,” illustrating how innovation is helping companies protect momentum even as macro conditions drag.

What is Driving Slowdowns?

When CEOs described what is slowing execution, three factors emerged most frequently.

- Roughly 35 percent pointed to budget freezes as the leading barrier, noting that even well-qualified opportunities are being delayed until spending restrictions ease.

- About a quarter highlighted extended approval cycles, with decisions getting caught in additional layers of review or, as one CEO described, “stuck in committee.”

- Another 20 percent pointed to internal bandwidth constraints, acknowledging that stretched teams are forcing leaders to prioritize only the initiatives most critical to near-term growth.

Taken together, these factors explain why even companies with strong pipelines are experiencing slower-than-expected sales cycles. As one CEO summarized, “We are still seeing opportunities, but the pace of execution is constrained in ways we have not experienced before.”

Where CEOs See Opportunities

Despite headwinds, CEOs are not standing still. Instead, they are identifying levers that create advantage in this environment.

- AI adoption is leading the way. What was once experimental is now mainstream, and CEOs are reporting tangible results in shortened sales cycles, improved forecasting, and measurable efficiency gains across the organization.

- Selective investment is another clear trend. CEOs are concentrating capital and talent on opportunities with the highest likelihood of revenue conversion, often shelving or delaying initiatives that do not have a clear payoff.

- Finally, resilient sectors continue to stand out. Companies with strong product-market fit are maintaining momentum, and CEOs in these industries are leaning into customer demand to reinforce their position.

AI in particular is no longer optional. It is reshaping sales cycles and execution across industries, and the efficiency gains are proving too material to ignore. The broader theme is that even in a challenging climate, CEOs are finding ways to convert disruption into leverage. Those who can integrate AI, allocate capital with discipline, and double down on proven markets are positioned not just to survive but to gain ground.

What This Means for CEOs Right Now

The findings confirm what most CEOs are already living every day: leading a company in 2025 requires both confidence and caution. The CEOs who are thriving are those who stay agile, revisit pipeline health often, and leverage tools like AI to sharpen efficiency and execution. Just as importantly, they are communicating transparently to their Boards, investors, and employees about the realities of the environment.

The CEO role has always demanded resilience. In today’s climate, it demands even more discipline, speed of adjustment, the ability to find growth in unexpected places, and the capacity to lead the company through uncharted waters.

Share Your Perspective

The insights we have gathered reflect how some CEOs in our High-Growth CEO Forums are navigating today’s complex business climate. We now want to broaden the lens. We invite you to add your perspective through our short CEO Outlook Survey. It takes only a few minutes, is completely anonymous, and will remain open until October 30.

We will publish the aggregated results on LinkedIn in early November so you can compare your outlook with that of your peers.